Bank’s Debits and Credits

When you hear your banker say, “I’ll credit your checking account,” it means the transaction will increase your checking account balance. Conversely, if your bank debits your account (e.g., takes a monthly service charge from your account) your checking account balance decreases.

If you are new to the study of debits and credits in accounting, this may seem puzzling. After all, you learned that debiting the Cash account in the general ledger increases its balance, yet your bank says it is crediting your checking account to increase its balance. Similarly, you learned that crediting the Cash account in the general ledger reduces its balance, yet your bank says it is debiting your checking account to reduce its balance.

Although the above may seem contradictory, we will illustrate below that a bank’s treatment of debits and credits is indeed consistent with the basic accounting procedure that you learned. Let’s look at three transactions and consider the related journal entries from both the bank’s perspective and the company’s perspective.

Transaction #1

Let’s say that your company, Debris Disposal, receives $100 of currency from a customer as a down payment for a future site cleanup service. When the money is received your company makes the following entry:

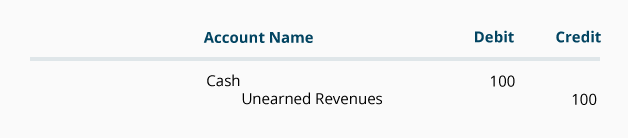

(Debris Disposal’s journal entry)

Because it has received cash, Debris Disposal increases its Cash account with a debit of $100. The rules of double-entry accounting require Debris Disposal to also enter a credit of $100 into another of its general ledger accounts. Since the company has not yet earned the $100, it cannot credit a revenue account. Instead, the liability account Unearned Revenues is credited because Debris Disposal has a liability to do the work or to return the $100. (An alternate title for the Unearned Revenues account is Customer Deposits.)

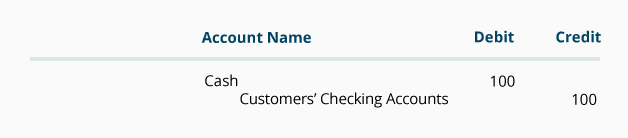

Now let’s say you take that $100 to Trustworthy Bank and deposit it into Debris Disposal’s checking account. Since Trustworthy Bank is receiving cash of $100, the bank debits its general ledger Cash account for $100, thereby increasing the bank’s assets. The rules of double-entry accounting require the bank to also enter a credit of $100 into another of the bank’s general ledger accounts. Because the bank has not earned the $100, it cannot credit a revenue account. Instead, the bank credits a liability account such as Customers’ Checking Accounts to reflect the bank’s obligation/liability to return the $100 to Debris Disposal on demand. In general journal format the bank’s entry is:

(Trustworthy Bank’s journal entry)

As the entry shows, the bank’s assets increase by the debit of $100 and the bank’s liabilities increase by the credit of $100. The bank’s detailed records show that Debris Disposal’s checking account is the specific liability that increased.

Transaction #2

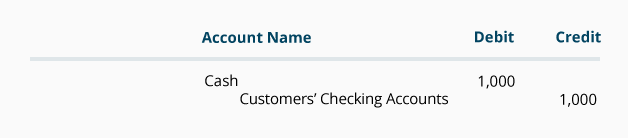

Let’s say Trustworthy Bank receives a $1,000 wire transfer on your company’s behalf from a person who owes money to Debris Disposal. Two things happen at the bank: (1) The bank receives $1,000, and (2) the bank records its obligation to give the money to Debris Disposal on demand. These two facts are entered into the bank’s general ledger as follows:

(Trustworthy Bank’s journal entry)

The debit increases the bank’s assets by $1,000 and the credit increases the bank’s liabilities by $1,000. The bank’s detailed records show that Debris Disposal’s checking account is the specific liability that increased.

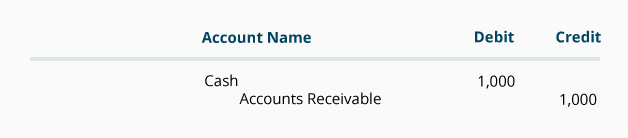

At the same time the $1,000 wire transfer is received at the bank, Debris Disposal makes the following entry into its general ledger:

(Debris Disposal’s journal entry)

As a result of collecting $1,000 from one of its customers, Debris Disposal’s Cash balance increases and its Accounts Receivable balance decreases.

Transaction #3

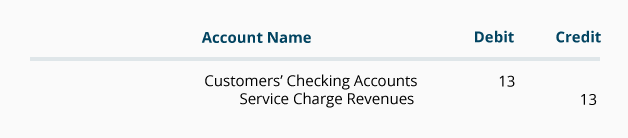

Many banks charge a monthly fee on checking accounts. If Trustworthy Bank decreases Debris Disposal’s checking account balance by $13.00 to pay for the bank’s monthly service charge, this might be itemized on Debris Disposal’s bank statement as a “debit memo.” The entry in the bank’s records will show the bank’s liability being reduced (because the bank owes Debris Disposal $13 less). It also shows that the bank earned revenues of $13 by servicing the checking account.

(Trustworthy Bank’s general ledger)

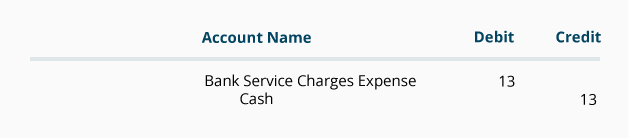

On your company’s records, the entry will look like this:

(Debris Disposal’s general ledger)

Debris Disposal’s cash is reduced with a credit of $13 and expenses are increased with a debit of $13. (If the amount of the bank’s service charges is not significant a company may debit the charge to Miscellaneous Expense.)

Please let us know how we can improve this explanation

No ThanksBank’s Balance Sheet

Accounts such as Cash, Investment Securities, and Loans Receivable are reported as assets on the bank’s balance sheet. Customers’ bank accounts are reported as liabilities and include the balances in its customers’ checking and savings accounts as well as certificates of deposit. In effect, your bank statement is just one of thousands of subsidiary records that account for millions of dollars that a bank owes to its depositors.

Please let us know how we can improve this explanation

No ThanksRecap

Here are some of the highlights from this explanation:

- Debit means left.

- Credit means right.

- Every transaction affects two accounts or more.

- At least one account will be debited and at least one account will be credited.

- The total of the amount(s) entered as debits must equal the total of the amount(s) entered as credits.

- When cash is received, debit Cash.

- When cash is paid out, credit Cash.

- To increase an asset, debit the asset account.

- To increase a liability, credit the liability account.

- To increase owner’s equity, credit an owner’s equity account.

- To increase revenues, credit the revenues account

- A credit to a revenue account also causes an increase in owner’s equity

- To increase expenses, debit the expense account

- A debit to an expense account also causes a decrease in owner’s equity

Please let us know how we can improve this explanation

No ThanksWhen you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement.

Earn Our Certificate

for This Topic