Introduction to Depreciation

Did you know? To make the topic of Depreciation even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our depreciation cheat sheet, flashcards, quick tests, business forms, and more.

What is Depreciation?

Depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in which the asset is used. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever.

Reason for Depreciation

Depreciation is necessary for measuring a company’s net income in each accounting period. To demonstrate this, let’s assume that a retailer purchases a $70,000 truck on the first day of the current year, but the truck is expected to be used for seven years. It is not logical for the retailer to report the $70,000 as an expense in the current year and then report $0 expense during the remaining 6 years. However, it is logical to report $10,000 of expense in each of the 7 years that the truck is expected to be used.

Accountants often say that the purpose of depreciation is to match the cost of the truck with the revenues that are being earned by using the truck. Others say that the truck’s cost is being matched to the periods in which the truck is being used up.

Examples of Assets to be Depreciated

Some examples of assets that are depreciated include:

- Buildings (excluding land)

- Machinery and equipment

- Trucks and automobiles

- Computer systems

- Furniture and fixtures

- Land improvements (parking lots, outdoor lighting, etc.)

These assets are often described as depreciable assets, fixed assets, plant assets, productive assets, tangible assets, capital assets, and constructed assets.

How These Assets are Recorded

The assets to be depreciated are initially recorded in the accounting records at their cost. Cost is defined as all costs that were necessary to get the asset in place and ready for use.

To illustrate the cost of an asset, assume that a company paid $10,000 to purchase used equipment located 200 miles away. The company then paid $2,000 to transport the equipment to its location. Finally, the company paid $5,000 to get the equipment in working condition. The company will record the equipment in its general ledger account Equipment at the cost of $17,000.

The balance in the Equipment account will be reported on the company’s balance sheet under the asset heading property, plant and equipment.

How Depreciation is Calculated

The calculation of depreciation involves the following:

-

The asset’s cost

The asset’s cost includes all costs necessary to get the asset in place and ready for use. -

The asset’s estimated salvage value

The asset’s estimated salvage value is the amount that the company will receive at the end of the asset’s useful life. The estimated salvage value is also referred to as the asset’s residual value or disposal value. It is common for companies to use a salvage value of $0 in the depreciation calculation. -

The asset’s estimated useful life

The asset’s estimated useful life is the number of years (or the total units of output) that the asset is expected to be used. The useful life can be more or less than its physical life. For example, a computer may have a physical life of 10 years, but due to expected changes in software and hardware, the computer’s useful life may be 3 years.

One formula that is commonly used to calculate depreciation expense for a year is:

(Asset’s cost – estimated salvage value) / estimated years of useful life

The asset’s cost minus its estimated salvage value is known as the asset’s depreciable cost. It is the depreciable cost that is systematically allocated to expense during the asset’s useful life.

How Depreciation is Recorded

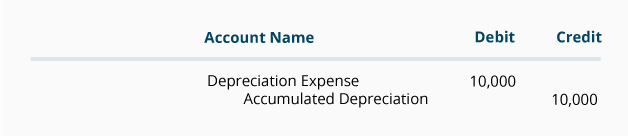

Depreciation is recorded in a company’s accounts with an adjusting entry that is typically recorded at the end of each accounting period. Except for equipment and facilities used in manufacturing, the adjusting entry for depreciation will involve the following general ledger accounts:

- Depreciation Expense

- Accumulated Depreciation

For instance, if the depreciation of a company’s delivery truck is $10,000 per year for 7 years and the company prepares only annual financial statements as of December 31, the adjusting entry for each of the 7 years will be the following:

This entry indicates that the account Depreciation Expense is being debited for $10,000 and the account Accumulated Depreciation is being credited for $10,000.

Depreciation Expense

Depreciation Expense is an income statement account. Income statement accounts are referred to as temporary accounts since their account balances are closed to a stockholders’ equity account after the annual income statement is prepared.

Since the balance is closed at the end of each accounting year, the account Depreciation Expense will begin the next accounting year with a balance of $0.

Accumulated Depreciation

Accumulated Depreciation is a balance sheet account that is associated with an asset that is being depreciated. For example, there will be an account Accumulated Depreciation – Truck that is associated with the asset account Truck.

The account Accumulated Depreciation is known as a contra asset account, since the account will appear in the asset section of the balance sheet, but it will have a credit balance (which is contrary to the normal debit balance for an asset account).

To illustrate an Accumulated Depreciation account, assume that a retailer purchased a delivery truck for $70,000 and it was recorded with a debit of $70,000 in the asset account Truck. Each year when the truck is depreciated by $10,000, the accounting entry will credit Accumulated Depreciation – Truck (instead of crediting the asset account Truck). This allows us to see both the truck’s original cost and the amount that has been depreciated since the time that the truck was put into service.

Unlike the account Depreciation Expense, the Accumulated Depreciation account is not closed at the end of each year. Instead, the balance in Accumulated Depreciation is carried forward to the next accounting period. To illustrate, let’s continue with our truck example. After the truck has been used for two years, the account Accumulated Depreciation – Truck will have a credit balance of $20,000. After three years, Accumulated Depreciation – Truck will have a credit balance of $30,000. Each year the credit balance in this account will increase by $10,000 until the credit balance reaches $70,000.

The difference between the debit balance in the asset account Truck and credit balance in Accumulated Depreciation – Truck is known as the truck’s book value or carrying value. At the end of three years the truck’s book value will be $40,000 ($70,000 minus $30,000).

Both the asset account Truck and the contra asset account Accumulated Depreciation – Truck are reported on the balance sheet under the asset heading property, plant and equipment.

Methods of Calculating Depreciation

There are many methods that a company may use to calculate the depreciation that will be reported on its financial statements. The following is a partial list of the depreciation methods that are available:

-

Straight-line method

Straight-line depreciation is by far the most common method used for computing and reporting depreciation on a company’s financial statements. Therefore, we will explain and demonstrate the details of calculating depreciation beginning with the straight-line method.

After learning some of the details in calculating depreciation using the straight-line method, we will provide examples of the following depreciation methods:

-

Units-of-activity or units-of-production

This method uses an asset’s output (instead of years) as an indicator of its useful life -

Double-declining-balance (DDB)

This method provides more depreciation expense in the early years of the asset’s useful life and therefore less depreciation expense in the later years of the asset’s life. The calculation for the DDB method uses the asset’s book value (which is always declining) and multiplies it by two times the straight-line depreciation rate. DDB is one of the accelerated methods of depreciation. -

Sum-of-the-years’-digits (SYD)

SYD is another accelerated method of depreciation. This means that a company will report more depreciation expense in the earlier years of the asset’s useful life and less depreciation in the later years.

The key difference in the depreciation methods involves when the asset’s cost is reported as depreciation expense on the company’s income statements:

-

If a company wants the same amount of depreciation expense each year, it will use the straight-line method.

-

If the company wants more depreciation expense in the years when an asset is used more, it will use the units-of-activity method.

-

If the company wants a greater amount of depreciation expense in the early years of an asset’s useful life (and therefore less in the later years), it will use an accelerated depreciation method such as the double-declining-balance method or the sum-of-the-years’-digits method.

Regardless of the depreciation method used, the total amount of depreciation expense over the useful life of an asset cannot exceed the asset’s depreciable cost (asset’s cost minus its estimated salvage value).

NOTE:

In our explanation of depreciation, we are discussing the depreciation which is reported on a company’s financial statements. This is commonly referred to as book depreciation.

We do not discuss the depreciation that is reported on a U.S. company’s income tax return. To learn about tax depreciation, visit www.IRS.gov or discuss tax depreciation with your tax adviser. (The depreciation method used on the company’s tax return can be different from the depreciation method used on the company’s financial statements…resulting in a tax benefit.)

Please let us know how we can improve this explanation

No Thanks