Introduction to Accounts Payable

Did you know? To make the topic of Accounts Payable even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounts payable cheat sheet, flashcards, quick test, and more.

Account payable is defined in Webster’s New Universal Unabridged Dictionary as:

account payable, pl. accounts payable. a liability to a creditor, carried on open account, usually for purchases of goods and services. [1935-40]

When a company orders and receives goods (or services) in advance of paying for them, we say that the company is purchasing the goods on account or on credit. The supplier (or vendor) of the goods on credit is also referred to as a creditor. If the company receiving the goods does not sign a promissory note, the vendor’s bill or invoice will be recorded by the company in its liability account Accounts Payable (or Trade Payables).

As is expected for a liability account, Accounts Payable will normally have a credit balance. Hence, when a vendor invoice is recorded, Accounts Payable will be credited and another account must be debited (as required by double-entry accounting). When an account payable is paid, Accounts Payable will be debited and Cash will be credited. Therefore, the credit balance in Accounts Payable should be equal to the amount of vendor invoices that have been recorded but have not yet been paid.

Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received. The same date is used to record the debit entry to an expense or asset account as appropriate. Hence, accountants say that under the accrual method of accounting expenses are reported when they are incurred (not when they are paid).

The term accounts payable can also refer to the person or staff that processes vendor invoices and pays the company’s bills. That’s why a supplier who hasn’t received payment from a customer will phone and ask to speak with “accounts payable.”

The accounts payable process involves reviewing an enormous amount of detail to ensure that only legitimate and accurate amounts are entered in the accounting system. Much of the information that needs to be reviewed will be found in the following documents:

- purchase orders issued by the company

- receiving reports issued by the company

- invoices from the company’s vendors

- contracts and other agreements

The accuracy and completeness of a company’s financial statements are dependent on the accounts payable process. A well-run accounts payable process will include:

- the timely processing of accurate and legitimate vendor invoices,

- accurate recording in the appropriate general ledger accounts, and

- the accrual of obligations and expenses that have not yet been completely processed.

The efficiency and effectiveness of the accounts payable process will also affect the company’s cash position, credit rating, and relationships with its suppliers.

Please let us know how we can improve this explanation

No ThanksAn Account Payable Is Another Company’s Account Receivable

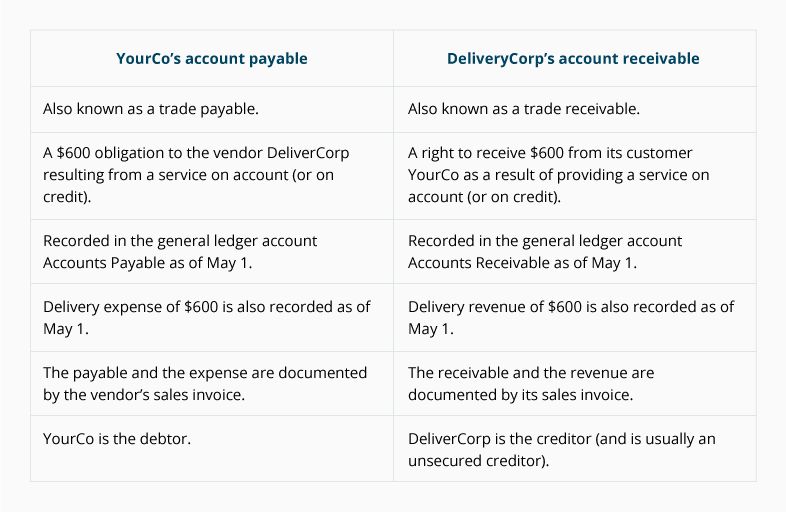

It may be helpful to note that an account payable at one company is an account receivable for the vendor that issued the sales invoice. To illustrate this, let’s assume that DeliverCorp provides a service for YourCo at a cost of $600 on May 1 and sends an invoice dated May 1 for $600. The invoice specifies that the amount will be due in 30 days. (We will assume throughout our explanation that the companies follow the accrual method of accounting.)

The following table highlights the symmetry between a company’s account payable and its vendor’s account receivable.

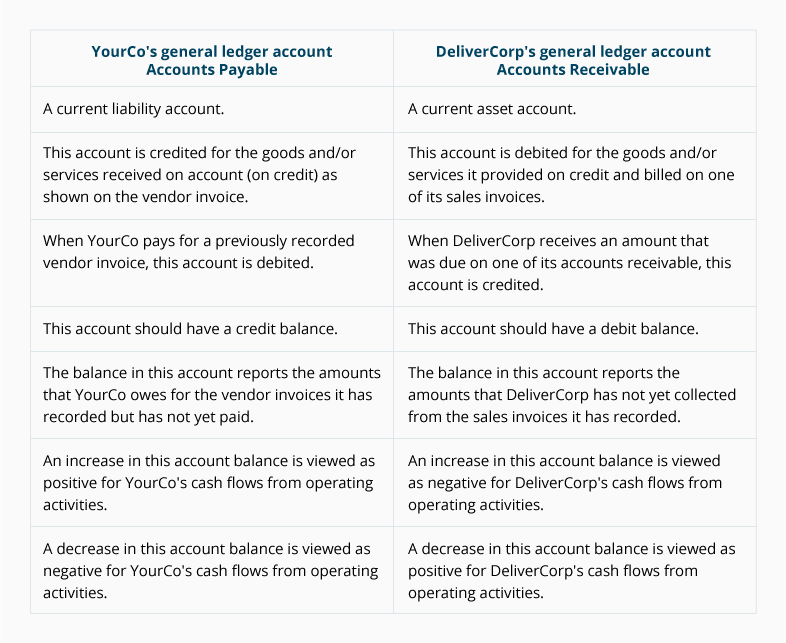

The following table focuses on the general ledger accounts: Accounts Payable and Accounts Receivable.

Please let us know how we can improve this explanation

No Thanks