Introduction to Accounting Principles

Did you know? To make the topic of Accounting Principles even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting principles cheat sheet, flashcards, quick test, and more.

The common rules that apply to the financial statements distributed by a U.S. company to external users are referred to as accounting principles, generally accepted accounting principles, GAAP (pronounced gap), or US GAAP. These rules or standards allow lenders, investors, and others to make comparisons between companies’ financial statements.

Since 1973, US GAAP has been developed and maintained by the Financial Accounting Standards Board (FASB), a non-government, not-for-profit organization. In 2009, the FASB launched the Accounting Standards Codification (ASC or Codification), which it continues to update. This electronic database contains the official accounting standards (the equivalent of many thousands of printed pages) which apply to the financial reporting of U.S companies and not-for-profit organizations.

[There is also an International Accounting Standards Board (IASB) that issues International Financial Reporting Standards (IFRS) which we will not be discussing.]

In addition to GAAP, U.S. corporations with capital stock trading on a stock exchange must also comply with the regulations of the Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS), both of which are U.S. government agencies.

In this explanation we begin with brief descriptions of many of the underlying principles, assumptions, concepts, and qualities upon which the complex and detailed accounting standards are based. Examples include historical cost, revenue recognition, full disclosure, materiality, and consistency.

We then review the effect of those underlying principles and concepts on a company’s financial statements such as:

- Required set of financial statements

- Accrual method of accounting

- Revenues reported on the income statement

- Expenses reported on the income statement

- Assets reported on the balance sheet

- Liabilities reported on the balance sheet

- Stockholders’ equity reported on the balance sheet

- Required notes to the financial statements

Please let us know how we can improve this explanation

No ThanksUnderlying Accounting Principles, Assumptions, etc.

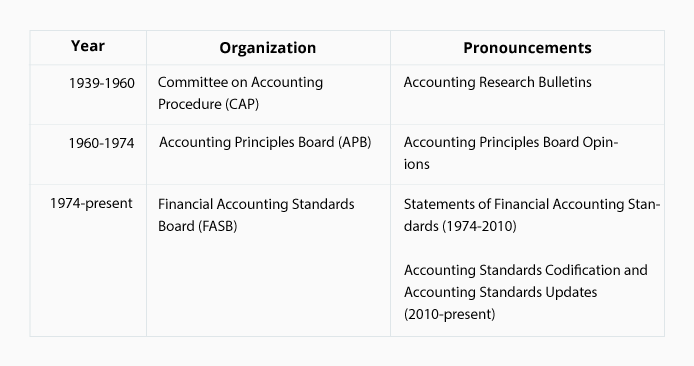

The following chart shows an overview of the accounting profession’s efforts in developing U.S. generally accepted accounting principles (GAAP or US GAAP):

Some of the accounting principles in the Accounting Research Bulletins remain in effect today and are included in the Accounting Standards Codification. However, due to the complexities and sophistication of today’s global business activities and financing, GAAP has become more extensive and more detailed.

Our focus is on the basic, fundamental principles and concepts and what they mean for a business’s financial statements.

We begin with brief descriptions of many of the underlying principles, assumptions, concepts, constraints, qualitative characteristics, etc.

Economic entity assumption

The economic entity assumption allows the accountant to keep the business transactions of a sole proprietorship separate from the sole proprietor’s personal transactions.

It also means that financial statements can be prepared for a group of separate legal corporations that are controlled by one corporation. This group of commonly owned corporations is referred to as the economic entity. The set of financial statements that reports the combined activity of the group is referred to as consolidated financial statements.

Monetary unit assumption

For U.S. companies, the monetary unit assumption allows accountants to express a company’s wide-ranging assets as dollar amounts. Further, it is assumed that the U.S. dollar does not lose its purchasing power over time. Because of this, the accountant combines the $10,000 spent on land in 1980 with the $300,000 spent on a similar adjacent parcel of land in 2023. The result is that the company’s balance sheet will report the combined cost of two parcels at $310,000.

Going concern assumption

The going concern assumption means the accountant believes that the company will not be liquidated in the foreseeable future. In other words, the company will be able to continue operating long enough to meet its obligations and commitments. As a result, the accountant can continue to report most assets at their historical cost and can defer some costs to future periods.

If the company is not considered to be a going concern (meaning the company will not be able to continue in business), it must be disclosed, and liquidation values become the relevant amounts.

Time period (or periodicity) assumption

Accountants assume that a company’s ongoing complex business operations and financial results can be divided into distinct time periods such as months, quarters, and years.

To report a company’s net income for each month, the company will prepare adjusting entries to record each month’s share of depreciation expense, property taxes, insurance, etc. It will also prepare adjusting entries for expenses that occurred but were not paid. Examples include repairs, interest, utilities, etc.

Cost principle

The cost principle (historical cost principle) means the accountant will record transactions at the cash (or equivalent) amount at the time of the transaction. As a result, a company’s most valuable assets are not recorded or reported. Examples include a company’s trademarks, talented team of researchers, unique website domain names, search engine rankings, etc.

Except for certain marketable investment securities, typically an asset’s recorded cost will not be changed due to inflation or market fluctuations.

Full disclosure principle

The full disclosure principle requires a company to provide sufficient information so that an intelligent user can make an informed decision. As a result of this principle, a company’s financial statements will include many disclosures and schedules in the notes to the financial statements.

Revenue recognition principle

Revenues are to be recognized (reported) on a company’s income statement when they are earned. Therefore, a company will report some revenues on its income statement before a customer pays for the goods or services it has received. In the case of cash sales, revenues will be reported when customers pay for their merchandise. If customers pay in advance, the revenues will be recognized (reported) after the money was received.

For example, if an insurance company receives $12,000 on Dec 28, 2023 to provide insurance protection for the year 2024, the insurance company will report $1,000 of revenue in each of the 12 months in the year 2024.

Matching principle or expense recognition

The ideal way to recognize (report) expenses on the income statement is based on a cause-and-effect relationship. For example, if a company sells 5,000 units of Product X, it should report the cost of the 5,000 units on the same income statement as the sales revenues. (Since the cost of sales may be 60% of the sales amount, it is imperative for the cost of goods sold to be calculated accurately.)

When a cause-and-effect relationship isn’t clear, expenses are reported in the accounting period when the cost is used up. For example, the $120,000 cost of equipment with a 10-year life will be charged to expense at a rate of $1,000 per month.

If neither of the above is logical, expenses are reported in the accounting period that the expenses occur. Examples are advertising expense, research expense, salary expense, and many others.

Materiality

The concept of materiality means an accounting principle can be ignored if the amount is insignificant. For instance, large companies usually have a policy of immediately expensing the cost of inexpensive equipment instead of depreciating it over its useful life of perhaps 5 years.

Materiality also allows for a mid-size company to report the amounts on its financial statements to the nearest thousand dollars.

Conservatism

If a company has two acceptable ways to record and/or report a transaction, conservatism directs the accountant to choose the alternative that results in less net income or a smaller asset amount. The accountant should be objective, but when doubt exists, conservatism should be used to break the tie.

Consistency and comparability

Accountants are expected to apply accounting principles, procedures, and practices consistently from period to period. If a change is justified, the change must be disclosed on the financial statements.

Comparability means that the user is able to compare the financial statements of one company to those of another company in the same industry. Comparability is enhanced by requiring the use of generally accepted accounting principles.

Relevance and timeliness

For financial statements to be relevant they should be distributed as soon as possible after the end of the accounting period. In other words, relevance is enhanced by timeliness.

To achieve these characteristics, it is likely that some amounts will need to be estimated.

Objectivity and reliability

Accountants are expected to be objective (unbiased). Many businesses are required to have their financial statements audited to assure the users that the amounts are objective and reliable.

Please let us know how we can improve this explanation

No Thanks